Blog - News and Tips

What Vehicle Expenses Can be Deducted by a Business?

Income Tax Act s. 18(1)

When any vehicle is used for both business and pleasure purposes, it is important to keep a  trip log to identify the business use of each vehicle.

trip log to identify the business use of each vehicle.

Vehicle Expenses - Unincorporated Businesses

An  unincorporated business (proprietorship or partnership) may deduct all reasonable

unincorporated business (proprietorship or partnership) may deduct all reasonable  motor vehicle expenses which are related to the business use of the vehicle (see

motor vehicle expenses which are related to the business use of the vehicle (see  trip log article), after applying the

trip log article), after applying the  limitations regarding passenger vehicles. If, for instance, 60% of your mileage is for business purposes (40% personal), you can deduct 60% of the expenses related to the vehicle.

limitations regarding passenger vehicles. If, for instance, 60% of your mileage is for business purposes (40% personal), you can deduct 60% of the expenses related to the vehicle.

See also the Canada Revenue Agency (CRA) interpretation bulletin  IT-521R Motor vehicle expenses claimed by self-employed individuals (Archived).

IT-521R Motor vehicle expenses claimed by self-employed individuals (Archived).

Vehicle Expenses - Corporations

Corporations may deduct all reasonable

Corporations may deduct all reasonable  motor vehicle expenses, after applying the

motor vehicle expenses, after applying the  limitations regarding passenger vehicles.

limitations regarding passenger vehicles.

If a shareholder or employee uses a company-owned  automobile for personal purposes, a

automobile for personal purposes, a  taxable benefit will be added to their income. The rules regarding automobile taxable benefits were changed starting in 2003, making it less costly to employees and shareholders to use company-owned vehicles for personal use.

taxable benefit will be added to their income. The rules regarding automobile taxable benefits were changed starting in 2003, making it less costly to employees and shareholders to use company-owned vehicles for personal use.

Before making the decision as to whether to purchase an automobile personally or in the company name, all the income tax implications should be reviewed.

In August 2019 CRA started an audit project related to corporate car expenses. Make sure you keep a  trip log of vehicle travel!!

trip log of vehicle travel!!

What Expenses are Included as Motor Vehicle Expenses?

Motor vehicle expenses include interest on loans to purchase automobiles,  capital cost allowance (CCA), automobile leasing costs, and operating expenses such as fuel, oil, maintenance and repairs, license and insurance costs, and car washes.

capital cost allowance (CCA), automobile leasing costs, and operating expenses such as fuel, oil, maintenance and repairs, license and insurance costs, and car washes.

Parking costs are not included as motor vehicle expenses. When the parking is related to business use of the motor vehicle it is 100% deductible, and when it is related to personal use it is not deductible.

If you have any questions regarding vehicle expenses or questions regarding other financial matters please  call us or book an appointment and we help make It Figure for you.

call us or book an appointment and we help make It Figure for you.

Source:  Taxtips.ca

Taxtips.ca

| |

May 31st, 2022

What is CERB?

Longer-term income support for workers, delivered first through Service Canada then through CRA, to provide support to workers who were not eligible for EI and were facing unemployment or reduced hours as a result of COVID-19. This included parents with children who require care or supervision due to school closures, and weren't able to earn employment income. CERB benefits are taxable. The amount received will be reported as income when your 2020 tax return is filed.

CERB Eligibility

CERB was available to workers who:

- live in Canada and are at least 15 years old

- have stopped working because of reasons related to COVID019, or are eligible for EI regular or sickness benefits, or have exhausted their EI regular or fishing benefits between Dec 29/19 and Oct 3/20

- had employment and/or self-employment income of at least $5,000 in 2019, or in the 12 months prior to the date of their application

- have not earned more than $1,000 in employment and/or self-employment income per 4-week benefit period while collecting the CERB

- have not quite their job voluntarily

End of CERB

On September 26th, 2020 the Canada Emergency Response Benefit program was ended and replaced by three separate programs named as follows the Canada Recovery Benefit (CRB), Canada Recovery Sickness Benefit (CRSB) and the Canada Recovery Caregiving Benefit (CRCB)

CERB Overpayments

Many people have received letters from Canada Revenue Agency (CRA) indicating that their eligibility for CERB could not be confirmed, and indicating they may have to pay back the CERB they received.

If you have received a letter from the CRA in regards to CERB, CRB, CRSB, or CRCB repayments or you just have questions please call us or book an appointment and we will help make It Figure for you.

Source:  taxtips.ca

taxtips.ca

Canada Emergency Response Benefit (CERB)

| |

| |

First Time Home Buyers and Disability Home Purchase Tax Credits

Income Tax Act s. 118.05

A non-refundable tax credit was enacted as part of the  2009 Federal Budget, based on an amount of $10,000 ($5,000 for taxation years prior to 2022) for first-time home buyers who acquire a qualifying home after January 27, 2009. The home is considered to be acquired once it is registered in your name in accordance with the land registration system or other similar system applicable where it is located (in Canada). The year of acquisition is the year in which the tax credit can be claimed. If you missed claiming this credit in the year of purchase, you can file an adjustment to your tax return.

2009 Federal Budget, based on an amount of $10,000 ($5,000 for taxation years prior to 2022) for first-time home buyers who acquire a qualifying home after January 27, 2009. The home is considered to be acquired once it is registered in your name in accordance with the land registration system or other similar system applicable where it is located (in Canada). The year of acquisition is the year in which the tax credit can be claimed. If you missed claiming this credit in the year of purchase, you can file an adjustment to your tax return.

Note that if a home is gifted to a person, as long as all other requirements are met, the person can still qualify for the home buyers' tax credit. The person who gifted the home is deemed to have disposed of it, and may have to report a capital gain.

The credit is also be available in respect of a home acquired by an individual who is eligible for the disability tax credit (DTC), or by an individual for the benefit of a DTC-eligible relative, if the home is acquired to enable the DTC-eligible person to live in a more accessible dwelling.

The credit can be claimed by the individual who acquires the home, or by the spouse or common-law partner of that individual, or can be split between spouses.

To be eligible for this credit, you must not have lived in another home owned by you or your spouse or common-law partner in the calendar year of the home purchase or in any of the four preceding calendar years.

Please contact our office if you have any questions or want to book an appointment for your 2022 Income Tax.

Source:  TaxTips.ca

TaxTips.ca

| |

Common Taxable Benefits

A number of common benefits in Canada are actually taxable benefits and must be reported when an individual files his personal income taxes. A taxable benefit is a payment from an employer to an employee that is considered a positive benefit and can be in the form of cash or other type of payment.

Some common benefits often considered taxable include tips, boarding, lodging, rent-free or low-rent housing, travel expenses for personal travel, personal use of an employer’s automobile, gifts over $500 per year, use of vacation property owned by the company, holiday trips, prizes and awards, life insurance premiums, and costs of employer-paid courses for personal interest not related to work.

Others include reimbursement for the cost of tools used in employment, loans to employees, tax equalization payments to relocate employees to offset higher taxes, income tax preparation fees and scholarships provided to children.

This is not a complete list, but these benefits are considered common benefits in Canada. To find the full list of taxable benefits please visit the  Canada Revenue Agency Website or contact our office if you have any questions.

Canada Revenue Agency Website or contact our office if you have any questions.

Source:  Canada.ca

Canada.ca

| |

Rules for Entertainment and Meal Expenses on Canadian Income Tax

Wouldn't the world be a beautiful place if as business people, we could deduct 100-percent of all of our business expenses on our taxes?

This is not the case and worse, when it comes to potential meals and entertainment and meal expenses on our Canadian income tax, a 100-percent deduction is rare.

This guide explains both the general rules governing food, beverage and entertainment expenses and those special situations where a 100-percent deduction can be claimed.

When Can You Claim Entertainment and Meal Expenses?

Self-employed people can claim food, beverage and entertainment expenses when these expenses are incurred for the purpose of earning income from a business or property. Learn more about what is and isn't considered to be a business expense.

What Is the 50-Percent Rule?

"The maximum amount you can claim for food, beverages, and entertainment expenses is 50% of either the amount you incur or an amount that is reasonable in the circumstances, whichever is less" according to the Canada Revenue Agency (CRA).

This 50-percent limit applies even when the amounts spent on food, beverages or entertainment are:

- Otherwise deductible as expenses

- Capitalized (for instance, included in the cost of land or depreciable property) or

- Included in the cost of inventory, scientific research and experimental development expenditures, exploration and development expenses, or other costs.

And while this information deals with food and entertainment expenses as they apply to business people and professionals, the 50-percent limit also applies to the food and entertainment expenses of employees, such as the expenses of commission salespersons and the travelling expenses of employees ordinarily required to work away from the employer’s place of business.

What About Taxes and Tips?

Income tax-wise, taxes and tips are included in the cost of food and beverages and are also subject to the 50-percent rule. For instance, you treated a client to lunch at a restaurant and the bill was:

$40 food

$2.00 GST (Alberta - 5%)

$6.00 Tip

The entire amount of $48.00 is subject to the 50-percent rule and you can claim $24.00 as a business expense.

You can Claim 100 Percent of Your Entertainment and Meal Expenses If:

1) You bill your client or customer for the meal and entertainment costs, and show these costs on the bill. The Canada Revenue Agency says,

"For example, a self-employed individual expends a reasonable amount for meals while away from home. This amount is ultimately billed to a client and is identified in the account submitted to the client as an expense relating to meals. The self-employed individual would be entitled to fully deduct the meal expenses. The 50% limitation would, however, apply to the client."

2) You are travelling by plane, train or bus and the cost of meals, beverages and entertainment is included in the travel fee.

It's a different case if you’re travelling by ship, boat or ferry, though; in that case, you can only claim 50 percent of any food, beverages and/or entertainment.

3) You include the amount of the entertainment and meal expenses in an employee's income or would include them if the employee did not work at a remote or special work location.

4) You incur meal and entertainment expenses for a Christmas party or similar event, and you invite all your employees from a particular location.

Note that the event doesn’t have to be held at your place of business; if you host an event for all employees at a restaurant, rented hall or other location, you can still deduct 100 percent of your food and entertainment expenses.

However, the guest list has to be democratic. If, for instance, your party or event is only available to owners, partners, managers or shareholders and/or selected employees, your expense deductions are limited to 50 percent.

Note, too, that you can only claim expenses for six such events a year.

5) You incur meal and entertainment expenses for a fund-raising event that was mainly for the benefit of a registered charity.

But be cautious; you can only claim 100 percent of these expenses if the event is a fund-raising event, not if the event is "part of the regular activities of a registered charity to accomplish its objectives".

What About Conventions and Seminars?

1) The first thing you need to know about food and beverage expenses related to conventions and seminars you attend for business purposes is that incidental food and beverages don’t count. In other words, you don’t get to claim the cost of the doughnuts, muffins, juice, coffee or any other “incidental” food or beverage provided to you.

2) The second is that if you attend a convention, conference or seminar where you are provided with meals or entertainment, and no amount of the fee you pay is specifically allocated to the costs of those food, meals or entertainment, you must claim $50 a day as an entertainment and meal expense – but this is subject to the 50 percent limit, so, you can only claim half of this amount, or $25, each day.

And note that “the fee for the conference, convention, seminar or similar event is deemed to be the actual fee paid or payable minus the amount deemed to have been paid or payable for food, beverages and entertainment” (CRA) – meaning that your food and entertainment claim has to be deducted from the conference fee.

For example

Suppose you pay $1,200 to attend a two-day business management conference. There’s no specific reference to the cost of food or entertainment in your registration fee, but you are provided with breakfast, lunch and dinner each day.

To claim your business deduction for the conference, you need to deduct $50 deemed to be paid for food, beverages and entertainment each day from the conference fee:

$1,200 – $100 = $1,100

In addition, you can claim 50 percent of the $100 as a meal and entertainment expense ($50).

$ 1,100 + $50 = $1,150 - your maximum deduction for the conference expense.

3) The third thing you need to know about expenses related to conferences and seminars is that you can only claim expenses for two a year.

Some Businesses Have Special Entertainment and Meal Deduction Rules

Businesses that regularly provide food, beverages or entertainment for compensation, such as restaurants or hotels, are exempt from the 50 percent rule and can claim 100% deductions for such expenses. (Note though, that this exemption only applies to food, beverages and entertainment supplied in the regular course of doing business. For example, if you run a winery and take a customer out to lunch, you could only claim 50 percent of your meal expenses.)

Long-haul truckers can claim 80% of the food and beverages they consume during eligible travel periods (a period of at least 24 continuous hours away from where they live and transporting goods at least 160 kilometres away).

Self-employed foot and bicycle couriers and rickshaw drivers can claim 100% of the extra food and beverages they need to consume in a normal eight hour work day (or, for 2006 and later tax years, a daily flat rate of $17.50).

What Counts as Entertainment?

All kinds of things. The Income Tax Act includes amusement, recreation and the “enjoyment of entertainment” as entertainment.

Some expenses that would qualify as entertainment expenses are obvious – the costs of tickets for performances or sporting events, or the cost of renting a hospitality suite.

Some are less obvious but still claimable, such as the cost of providing a security escort or a tour guide for a business client.

All are subject to the 50 percent rule, including related expenses such as taxes, tips and cover charges as explained previously in the Taxes and Tips section of this article.

All such expenses need to be completely documented so you can prove that the expense was directly related to earning income. The Canada Revenue Agency recommends that;

"Records should be maintained of the names and business addresses of the customers or other persons being entertained, together with the relevant places, dates, times and amounts supported by such vouchers as are reasonably obtainable."

For more information on Food, Beverages and Entertainment Expenses see the Canada Revenue Agency's Income Tax Interpretation Bulletin IT-518R.

You may also wish to refer to their IT131R2 Convention Expenses.

How to Claim Meals and Entertainment Expenses

If you are operating your business as a sole proprietorship or partnership, claiming your business expenses is part of completing Form T2125, Statement of Business or Professional Income as part of your T1 income tax return.

Source:  thebalancesmb.com

thebalancesmb.com

| |

Three Tips You Haven't Heard About Starting Your Own Business

If you’ve thought about opening your own business, you might have begun to look for advice. There are so many tips for starting a new business out there, that choosing which one to follow can get confusing.

I can tell you that there is no perfect formula for starting a small business. I’ve learned that the best business advice usually forces you to think in a new way. So, I’ve compiled a list of tips for starting your own business that you might not have heard.

Tips for Starting your Small Business

Opening your own business is often a learn-as-you-go process. But, the smarter the decisions you make early on, the better chance your company has for success. If you have an entrepreneurial idea, try these ten tips.

1. Address Excuses

Countless people dream of becoming entrepreneurs, but they never do. They’re burdened with excuses and fears of failing. From money to time to responsibilities, you can make a million cases for not starting a business.

Let’s face it, being your own boss is scary. In most cases, new business owners have a lot to lose with little insight into their chances of success. Worrying about the risks of business ownership is normal.

But, excuses only slow you down from reaching your goals. If you really want to start a business, you need to address the reasons you think you can’t start a business and get rid of them. Find a solution to the issue rather than let it hold you back.

2. Absorb Everything

Listen to what others have to say—friends, family, experts, even yourself. When it comes to things that have to do with your entrepreneurial goals, be a sponge. As you learn, start to work out the idea in your head. Write things down. Keep notes from all the resources you come across to develop a detailed plan.

When you tell people about your start-up, read their body language. Do they like the idea? Or, are they just being nice and really think you’re going in the wrong direction? Encourage your listeners to be honest with you. The collective opinion you get from peers could be a reflection of how consumers will react.

Don’t ignore the power of advice from experts and veteran business owners. These folks know first-hand what does and doesn’t work. Smart entrepreneurs learn from the mistakes other business owners have made.

3. Be a Solution

Rather than starting your idea with what to sell, think about what it will solve. It’s a lot easier to gain a solid customer base when your business is fixing a problem. Your start-up should fill a hole in a certain market or niche.

Why Good Customer Service is Critical to Small Business

For small businesses, committing to continually strive to provide the best customer service possible is especially important because:

1. Customer loyalty is crucial to most small business’s bottom line. Good customer service is the prime driver of customer loyalty. On average, loyal customers are worth up to 10 times as much as their first purchase according to the White House Office of Consumer Affairs.

2. Good customer service saves small business’s money. Depending on which study you believe, and what industry you’re in, acquiring a new customer is anywhere from five to 25 times more expensive than retaining an existing one (Harvard Business Review).

3. Businesses (especially small businesses) can’t survive long-term bad press. Customers judge the customer service of every business they deal with — and they’re much more likely to share bad ratings with other people than good. What happens after poor customer experience?

- 78 percent of customers cancelled a transaction or intended purchase after poor customer service (American Express Survey)

- 96 percent of customers don't bother to complain to the business, and 91 percent never come back ("Understanding Customers" by Ruby Newell-Legner)

Dissatisfied customers will tell between nine to 15 people about their experience — and about 13 percent of dissatisfied customers tell more than 20 people about their poor experience, according to the White House Office of Consumer Affairs. On the other hand, happy customers who have their issues resolved tell between four to six people about their experience.

The stakes are even higher given that complaints about customer service are easily disseminated on social media platforms such as Facebook and Twitter and reflected in online reviews (such as Google reviews).

4. Providing top-notch customer service is one of the few ways small businesses can compete with larger retailers.

In fact, as Daniel Butler, vice president of Retail Operations for the National Retail Federation, points out, this “buyer experience” is where owners of small stores have a big advantage over their chain-store counterparts.

“They can actually be in touch with their customers and make a personal connection.”

| |

| |

Tips for Better Business Etiquette

In the business world, good manners are essential for getting ahead. Proper etiquette can help people land jobs, get promotions and establish excellent relationships with others. The most successful businessmen and women know how to turn on the charm and exhibit their best business etiquette to get the job done professionally and effectively.

1. Listening Skills

Communication is the lifeblood of business. For people to get along, work in unison and establish professional relationships with one another, they must communicate with the appropriate etiquette. Listening skills are a main part of communication etiquette. When others are speaking do not interrupt them. Employ active listening techniques, such as making good eye contact and showing the speaker that you are paying attention to them.

2. Meetings

The Society for Technical Communication says it is proper business etiquette to show up on time, or, preferably, a few minutes early to meetings. Come prepared with pen and paper.

3. Attire

The way you dress impacts whether you have good business etiquette. The business world is professional, and the people who work in it must dress to reflect that level of professionalism. As such, make sure your clothes are clean and pressed, and that you wear suits, blouses, skirts, blazers, ties or other clothing that makes a good impression.

4. Politeness

Remember to always say please and thank you when you interact with others, in person or over written correspondence. Being polite makes you pleasant to work with and shows respect.

5. Best Behavior

To be on your best behavior, always give others your utmost attention when they are speaking or conducting a presentation. Put your cell phone away during this time and do not engage in side conversations with coworkers.

6. Handshake

Shaking hands with your business counterparts establishes rapport and is in good form. For international interactions, research how that culture greets one another professionally in business, as not all countries see shaking hands as a form of respect.

7. Table Manners

There will be times when you have to attend a business luncheon. According to the University of Delaware, some tableside manners to practice are not speaking with your mouth full, using your napkin and not setting bags or briefcases on the table.

8. Diplomacy

Ravenwerks, an organization for global ethics, etiquette and effectiveness, says to always be diplomatic when engaged in a business conversation, even if you disagree with what others are saying. Apologize if you step on other peoples’ toes, but do not be afraid to hold true to your convictions.

9. Tone

Never raise your voice to others in the work environment, or use foul language toward them. Keep your tone as neutral as possible, and avoid “talking down” to others.

10. Following Up

Following up correspondence is a proper gesture. After working with a client, customer or co-worker it is in good form to send a thank-you email or note, recognizing their business or efforts.

Put these little tips into everyday use and see how it can make a difference in your business career!

| |

Did You Stay at Home to Raise Young Children?

Make Sure You Apply for the Child Rearing Drop-out!!

If your children were born after December 31, 1958, and your CPP contributions were reduced while you stayed home or reduced your hours of work to be the primary caregiver for the children, you may be eligible to have the child rearing drop-out provision applied to your account when you apply for a CPP benefit (such as retirement or disability pension, or death or survivor benefits).

The CRDO applies for years when you were caring for your children who were under the age of 7 years. Application of the CRDO will increase your monthly CPP benefit.

The CPP Child Rearing Drop-out application must be completed at the same time as you apply for any CPP benefit. If you are already collecting a CPP benefit and did not know about the CRDO, contact Service Canada to apply to get your benefits increased retroactively.

For more information, see Child Rearing Drop-out Provision on the Canada Pension Plan Eligibility web page at  https://www.canada.ca/en/services/benefits/publicpensions/cpp/cpp-benefit/eligibility.html

https://www.canada.ca/en/services/benefits/publicpensions/cpp/cpp-benefit/eligibility.html

Source; www.canada.ca

| |

Seniors Property Tax Deferral Program

The Seniors Property Tax Deferral Program (SPTDP) allows eligible senior homeowners to defer all or part of their property taxes through a low-interest home equity loan with the Alberta government.

How It Works:

If you qualify, the Alberta government will pay your residential property taxes directly to your municipality on your behalf. You re-pay the loan, with interest, when you sell the home, or sooner if you wish. The current interest rate is 2.70%

The SPTDP is voluntary, so it’s up to you whether you want to apply.

As with any important financial decision, you may wish to consult with your family or a financial adviser to decide whether this program is right for you.

Eligibility:

To qualify for the Seniors Property Tax Deferral Program, you must:

Be 65 years or older

Be an Alberta resident

Own a residential property in Alberta

Have a minimum of 25% equity in your home

Only residential properties are eligible. The home must be your primary residence (that is, the place where you live most of the time).

Apply:

Apply today for the Seniors Property Tax Deferral Program and free up money for other household priorities or expenses.

Download the SPTDP Information Guide, Application and Agreement

Download the SPTDP Information Guide, Application and Agreement

You can apply for the SPTDP at any time. However, to allow enough time for your application to be processed and payment forwarded to your municipality (and avoid penalties), you should apply at least 30 days before the property tax deadline. For example, if your taxes are due on June 30, we should receive your application by May 31.

Mail your completed application form to:

Seniors Property Tax Deferral Program

PO Box 1200

Edmonton, Alberta

T5J 2M4

Late Application:

You can apply at any time of year. If you miss your municipal property tax deadline, however, you will be responsible for any late charges. You can choose to pay those charges directly to the municipality or you can have these charges added to the amount of your loan.

If you owe money from previous years’ property taxes, you can still apply to the SPTDP, as long as you have a minimum of 25% equity in your home.

Loan Repayment:

You can choose to repay the loan at any time, but it will automatically become due when:

1. You sell your home;

2. You are no longer a registered owner; or

3. The home is no longer your primary residence

To repay your loan or make a partial payment, visit your nearest ATB branch and provide your loan number which can be found on your loan statement.

Make your cheque payable to the Government of Alberta and write your loan number on the cheque.

| |

Do You Want to be Financially Independent at 50?

If you are careful with your money and make good financial choices, you can have the financial independence to do whatever you want. Have you noticed that many people earn a lot of money and seem to be just "getting by"? Yet there are people who have low incomes and do very well. How much money you earn isn't the only thing that matters. What matters more is how you handle the money you have. The difference between getting by and being financially independent is actually very small.

People who are financially independent aren't necessarily making more money or smarter than others, but they are probably better at making financial decisions. They set their goals, make a plan, and stick to it. They look at tax implications, returns and risk, project all the figures into the future, and then decide on a course of action. When you have all the information, making decisions becomes much easier.

Every person's situation is different, and one plan does not fit all. You need to sit down, define your goals, and figure out your own plan. Life is a series of choices, and every person is the master of their own fate. Forming and following the plan requires that you make choices, some of which can be difficult, and some of which will require a lot of dedication. Everyone's goals should include buying their own home, and getting out of non-tax-deductible debt as quickly as possible.

Check out these tax calculators at  http://www.taxtips.ca/calculators.htm. They will allow you to compare different scenarios. You will be able to see what a big difference a small change in your money management decisions can make.

http://www.taxtips.ca/calculators.htm. They will allow you to compare different scenarios. You will be able to see what a big difference a small change in your money management decisions can make.

Happy financial planning!

| |

How To Be A Better Business Owner

The biggest problem founders and small business owners have is that they’re experts in their field and novices in what it really takes to effectively run a business. That’s what usually trips them up, sooner or later.

Don’t let that happen to you. Admit that you don’t know what you don’t know about business, starting with these 15 tips guaranteed to help keep you and your company out of hot water.

Always make sure there is and will be enough cash in the bank.

Period. The most common business-failure mode, hands down, is running out of cash. If you know you’ve got a cash flow or liquidity problem coming up, fix it now.

You can’t fire bad employees fast enough.

You just can’t. Just make sure you know they’re the problem, not you (see next tip).

The problem is probably you.

When I was a young manager, my company sent us all to a week of quality training where the most important concept we learned was that 90 percent of all problems are management problems. When things aren’t going well, the first place to look for answers is in the mirror.

Take care of your stars.

This goes for every company, big and small. The cost of losing a star employee is enormous, yet business leaders rarely take the time to ensure their top performers are properly motivated, challenged, and compensated.

Your people are not your kids, your personal assistants, or your shrink.

Learn to say "yes" and "no" a lot.

The two most important words business owners and founders have at their disposal are “yes” and “no.” Learn to say them a lot. And that means being decisive. The most important reason to focus – to be clear on what your company does – is to be clear on all the things it doesn’t do.

Listen to your customers.

It boggles my mind how little most entrepreneurs value their customers when, not only are their feedback and input among the most critical information they will ever learn, but their repeat business is the easiest business to get.

Learn two words: meritocracy and nepotism.

The first is how you run an organization – by recognizing, rewarding, and compensating based solely on ability and achievement. The second is how you don’t run an organization – by playing favorites and being biased.

Know when and when not to be transparent.

Transparency is as detrimental at sometimes as it is beneficial at others. There are times to share openly and times to zip it. You need to know when and with whom to do one versus the other. It comes with experience.

Trust your gut.

This phrase is often repeated but rarely understood. It means that your own instincts are an extremely valuable decision-making tool. Too often we end up saying in retrospect and with regret, “Damn, I knew that was a bad idea.” But the key is to know how to access your instincts. Just sit, be quiet, and listen to yourself.

Protect and defend your intellectual property.

Most of you don’t know the difference between a copyright, trademark, trade secret, and patent. That’s not acceptable. If you don’t protect and defend your IP, you will lose your only competitive advantage.

Learn to read and write effective agreements.

You know the expression “good fences make good neighbors?” It’s the same in business. The more effective your agreements are, the better your business relationships will be.

Run your business like a business.

Far too many entrepreneurs run their business like an extension of their personal finances. Bad idea. Very bad idea. Construct the right business entity and keep it separate from your personal life.

Know your finances inside and out.

If you don’t know your revenues, expenses, capital requirements, profits (gross and net), debt, cash flow, and effective tax rate – among other things – you’re asking for trouble. Big trouble.

You don’t know what you don’t know.

Humility is a powerful trait for leaders, and that goes for new business owners, veteran CEOs of Fortune 500 companies, and everyone in between. More times than not, you will come to regret thinking you knew all the answers.

www.taxtips.ca

www.taxtips.ca

| |

5 Secrets to Corporate Gift Giving

Companies typically give gifts to three groups of people: their clients, their employees and prospective large clients. Gifting is a must, so it should not be seen just as an expense but rather as an investment. You invest in building a relationship with clients and you invest in the happiness of your employees. Gifting can help establish strong client and employee relationships which can lead to client and employee retention and ultimately loyalty.

What are the top 5 elements that make a corporate gift perfect?

Customization – The more you know about your client, the more tailored a gift can be. By sending the client a personalized gift, they will appreciate the thought you have put into it and how much you value their business.

Element of Surprise – Although sending gifts on holidays is a nice gesture, your client is most likely receiving gifts from all other companies they work with. What they don’t expect is a gift from you celebrating your one-year working relationship together, or a Valentine’s Day gift saying how much you appreciate them. If you would like to stick with normal holidays, maybe surprise your client with not just a gift for them but a gift for them and their family to enjoy together.

Use Your Budget Wisely – Rather than spending money on a lot of items to make your gift look enormous but only contain mediocre items – focus on the quality and get a top of the line small item instead.

Limit Swag – Try to keep the focus of the gift on pleasing the customer. Limit the amount of swag in the gift or the gift will seem more like a walking advertisement for you and not as sincere.

Support Local – Try to support other local companies when sourcing gifts. It makes your gift more unique, memorable and personal. It also shows your efforts to make a gift wonderful.

Good luck with your gift giving!

| |

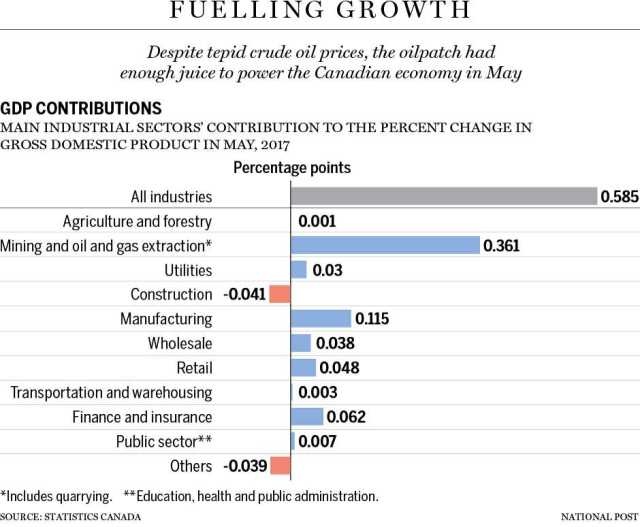

Canada's Economic Growth Expectations for 2017

Canada’s economy accelerated far more than expected in May amid growth in the energy and manufacturing sectors, pointing to solid momentum in the second quarter and raising expectations for a second interest rate hike in the coming months.

Markets see a 73.6 percent chance of a rate increase at the bank’s October meeting, up from a 67.2 percent ahead of the data. Traders see 37.7 percent odds the bank will move as soon as its next meeting in September.

Many economists expect the central bank will wait until October so as not to shock the economy with a rapid rise in borrowing costs, given the recent rise in the Canadian dollar which makes exporters less competitive.

Goods-producing industries led May’s growth, rising 1.6 percent. Oil and gas extraction surged 7.6 percent as activity at a facility in Alberta recovered after a fire and explosion in March that caused production difficulties. other areas of growth were also strong, including manufacturing and retail, with the second quarter on track for growth of around 3.5 per cent, said Exarhos.

That would add on to 3.7 per cent growth in the first quarter, which made Canada a leader among its industrialized peers and suggests the economy has turned the corner two years after being hit by tumbling oil prices.

Manufacturing activity rose 1.1 per cent, driven by makers of petroleum and coal products, as well as motor vehicles and parts.

The recent slowdown in Toronto home sales following provincial measures to rein in the market was starting to weigh on economic growth, with activity at offices of real estate agents and brokers tumbling 6.3 per cent.

| |

TFSA's - The Things You Need To Know

You might know already what a TFSA is. It should not to be confused with an RRSP. A TFSA allows you to set money aside in eligible investments and watch those savings grow tax-free throughout your lifetime. Interest, dividends, and capital gains earned in a TFSA are tax-free for life. Your TFSA savings can be withdrawn from your account at any time, for any reason, and all withdrawals are tax-free.

Tax-free savings accounts (TFSA) are available for Canadian residents who are 18 years of age or older. The first tax year that they were available was in 2009. However, a brokerage account for a TFSA cannot necessarily be opened by an 18-year-old. A brokerage account can only be opened by someone who has reached the age of maturity in their province or territory.

Generally, the investments allowed in a tax free savings account are similar to those of the other plans and include everything from GICs to mortgages. In addition to making cash deposits to buy investments, you can make in-kind contributions by transferring shares and mutual funds you already own into a TFSA. The rule is that the investment must be arm’s length from you (for example, personal debt is not allowed) You must set one up through a financial institution, but you can make it a self-directed account and manage it on your own.

You can contribute $5,000 a year and carry forward the unused portion to the next year. But be careful, many Canadians have been confused by the rules and face penalties as a result. They withdrew money from their tax free savings account in, say in January, and then put the amount back in June. They were shocked to discover that the redeposit was considered a double payment and subject to a hefty tax penalty.

Since you can’t claim capital losses in your TFSA on investments that have gone sour, it is best to opt for blue chip equities with high-yield dividends to fill up your TFSA. Also, because the maximum annual contribution isn’t high enough to spread your market exposure around, it makes sense to choose investments such as exchange-traded funds that represent a broad sample of companies found in a stock market index.

| |

Take Simple Steps to Prevent Expense Fraud

Without clear and firm guidelines for expense reports, employees are more likely to cross the line. However, following these simple steps can mitigate the risk:

1. Start by defining your expense report policies. For example:

smaller companies will typically have a simpler set of policies than larger organizations. That said, the following recommendations apply to companies of all sizes:

require expenses be submitted within 30 to 60 days of incurring the expense

require receipts for all purchases over $25

require itemization of multi-category purchases such as hotel stays (pay-per-view movies go under “Entertainment,” room service belongs to “meals”, etc.)

2. Inform employees of policy violations before expense reports are submitted.

Expense report policies have traditionally resided in the employee handbook. The reality is that most employees don’t refer to the handbook when preparing their reports.

Consider adding an expense report system that automatically highlights policy violations and automatically identifies duplicate transactions. This immediate feedback loop not only improves policy compliance, but also reduces the burden on supervisors and accounting to identify and reject out-of-policy expenses.

3. Design a thorough expense review and approval process.

An effective approval chain starts with including the appropriate manager(s). The primary role of the approving managers is to ensure expenses are accurate and represent bona-fide business expenses. In many cases, multiple managers may be involved.

4. Utilize data analytics to stay on top of expense reporting trends.

Graphs and charts are handy when it comes to monitoring expense trends by employee, category and merchant. Companies should leverage their expense-report platform to identify and investigate unusual items.

Tightening up the expense-report process is an easy, but effective, way to prevent fraud at all levels.

Clear, thorough expense guidelines, as well as a commitment to ethical leadership, will keep a company’s revenue and reputation on track.

| |

Why you can't afford to be bad at Bookkeeping

Maintaining your books isn't something you should do solely as a tax-savings strategy; it can also prevent you from losing your sanity and getting dragged into a potential lawsuit over commingling your funds. Here are five significant reasons for maintaining a separate cheque book and set of books for each of your businesses:

1. Corporate veil. Maintaining a separate cheque book substantiates the corporate veil, one of the primary reasons for forming a new corporation. Having a separate cheque book shows you recognize the company is its own distinct entity. Furthermore, separate cheque books should encourage you not to commingle personal and business funds.

2. Tax savings. Separate banking will improve bookkeeping procedures, prevent payments from being missed, and provide better records to improve your tax return.

3. Audit protection. Having a separate cheque book will improve your chances in an CRA audit. The CRA will often disallow a number of expenses when personal and business expenses are commingled in a single cheque book.

4. Less stress and more sanity. When your books are disorganized, you’ll feel constant stress to take care of it, and this ultimately can cause you to feel undone. Having separate checking and bookkeeping for a new company will save you time and money in the long run.

5. Improved decision making. Having a separate cheque book starts the process of better bookkeeping, expense tracking, and budgeting, which leads to quality decision making. How can you expect to be a successful business owner without accurate records?

| |

How much cash do you need for your business's safety net?

In any business, liquidity is important. You need enough cash to pay your obligations. That is, over time the amount of cash that flows into your business must be greater than or equal to the amount of cash that flows out of your business.

You can endure negative cash flow in the short term by dipping into reserves, selling assets or raising capital (either debt or equity). How long you can sustain negative cash flow is a function of the size of the hole you are digging each month, the amount of reserves you have and your ability to raise cash. Nevertheless, you will eventually have to achieve positive cash flow or the business will go bankrupt.

Beyond simply meeting monthly obligations, it is a good idea to have a safety net -- a cash reserve to help you through lean times. Suppose a big customer doesn’t pay your invoice or sales decline significantly. Such events are common and a sufficient reserve will help you weather the storm long enough to make appropriate adjustments to your business.

The size of the safety net you need is a function of the volatility of your business. In stable businesses, a cash reserve equal to a couple of months of your obligations may be sufficient. In businesses that are more volatile, you may need a safety net that will see you through a drought of six months or more.

In general, liquidity that exceeds a reasonable safety net won’t hurt the business. However, we have seen companies that are flush with cash overspend.

Even if you don’t overspend, holding significant amounts of cash is a bad idea because it is an inefficient use of capital. It is much more prudent to invest the cash in growing your business or return it to shareholders so that they can invest it in other ventures. Appropriate liquidity is important for all businesses. Make sure you understand how much liquidity your business needs and develop a plan to achieve it.

| |

What you need to know about payment arrangements

Do you have a balance owing? Can’t pay in full? Work with the Canada Revenue Agency to resolve your tax debt now! If you cannot pay the full amount you owe now, you may qualify for a payment arrangement or ask for taxpayer relief. Take action by contacting the Canada Revenue Agency right away. Ignoring your debt does not make it go away.

The CRA can work with you to set up a payment arrangement in “My Account” or “My Business Account.” The sooner you take action, the less interest you’ll have to pay.

A payment arrangement with the CRA lets you make smaller payments over time, until you have paid your entire debt, including interest. To help the CRA determine your ability to pay, you may have to give details of your financial situation and proof of your income, expenses, assets, and liabilities.

Staying up to date with your tax obligations is an important part of managing your finances.

| |

Do you live in Northern Canada? Qualify for Northern Residence Deduction?

There are two northern resident deductions; a residency deduction for having lived in a prescribed northern or intermediate zone AND a deduction for travel benefits you received from employment in a prescribed zone that were included in your income

To qualify for the northern resident’s deductions, you must have lived, on a permanent basis, in one or more prescribed northern or intermediate zones for at least six consecutive months beginning or ending in the tax year. If you have not lived in a prescribed zone for at least six consecutive months, you do not qualify.

There are two parts to the residency deduction: a basic residency amount and an additional residency amount. The amount you can claim for these will depend on whether you lived in a prescribed northern or an intermediate zone. For 2016, you can claim a basic residency amount of $11 for each day you lived in a prescribed northern zone. Or if you lived in a prescribed intermediate zone, you can claim $5.50 per day.

The additional residency amount is $11 for each day you lived in a prescribed northern zone. Or if you lived in a prescribed intermediate zone, it is $5.50 per day. You can claim this additional amount only if you maintained and lived in a dwelling in the northern or intermediate zone and you are the only person in your household claiming the basic residency amount. You can claim the deduction for travel benefits that you received from your employer if you meet certain conditions.